Greetings all, hope you have been doing okay during these unprecedented times.

I have noticed on my Facebook groups that the topic of larger money transfers or even frequent money transfers come up over and over again.

Most of the time, people default to recommending Transferwise or Currencyfair. And don’t get me wrong in addition to OFX I use both of them quite frequently. They are great!

I used Transferwise only last week to send money from an Australian account to my Revolut travel card.

Whereas a while back for a larger transfer, I would always go with OFX.

But really what I want to highlight with this article is why I would use OFX for larger transfers. And of course, compare Transferwise Vs OFX.

In this example I am using today’s exchange rate so if you are comparing them in the future please keep that in mind.

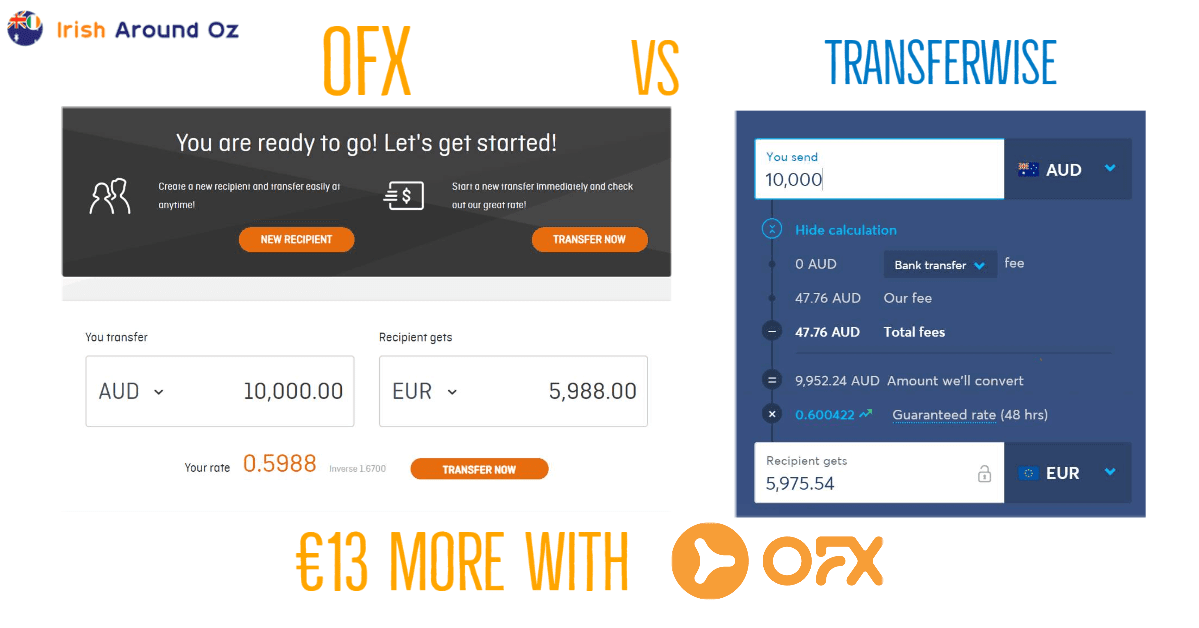

I also wanted to compare the typical amount that you would send back to Ireland after a few years in Australia, which is around AU$10k.

Some people send much larger amounts as well, which will also mean larger fees(from Transferwise).

We also have free transfers for life with OFX, register here.

So let’s get to the key points on Transferwise VS OFX!

-

- Transferwise’s transfer fee increases the more you send. In the example below of $10k, there is AU$47.76 in fees.

- Compare this to OFX who charge zero fees no matter how large your transfer is.

- Yes, Transferwise has some of the lowest fees in the money transfer industry, but you can see that have zero fees makes the difference.

- Support: OFX offer 24/7 support and hedging support which is especially important when dealing with larger transfers.

- Transfer times take roughly the same time 1 – 2 business days. So they are tie on this point.

- Below is a screenshot from today and as you can see OFX again comes out on top with a €13 difference.

You can see Transferwise’s fees and OFX’s transparency.

So who should you pick for sending money from Australia to Ireland, Transferwise or OFX?

Yes I know some of you are saying €13…. why bother? And to be fair, it is a good point. But for me, it’s not just the amount it is the extra security and confidence that you get with OFX.

If you have used Transferwise before you will know how automated it is.

And that is perfectly fine but when it comes to larger amounts not only will you be getting more in you bank account but a dedicated broker will be able to help advise you on the best time to transfer.

You can register with Transferwise here

Or if you are keen on OFX you can sign up with OFX and reserve free transfers for life with our link here.

Both companies do a great job of saving you money when compared to the bank, and I will leave it up to you to decide who is best for your needs.

Thanks for stopping by and I will try to be more active on the blog in the coming weeks.

If you enjoyed this post, you might also enjoy reading my post on Transferwise vs Currencyfair

Cheers,

Stephen